Ricoh Quick Aproval

With Ricoh Quick Approval

your credit union will be able to respond faster to your members, offering them better experiences on the road to achieving their business goals.

Ricoh Quick Approval is a predictive platform with artificial intelligence, supporting you in:

- Respond faster to your partners by providing 24/7 multichannel support.

- Capture new partners with personalized marketing actions.

- Keep your partner portfolio updated and segmented.

- Reduce portfolio risk provisions.

- Optimize the work of your risk analyst.

- Ensure confidential and secure handling of information.

Respond IN SECONDS to your partners about their credit approval, it is possible!

Discover how it works!

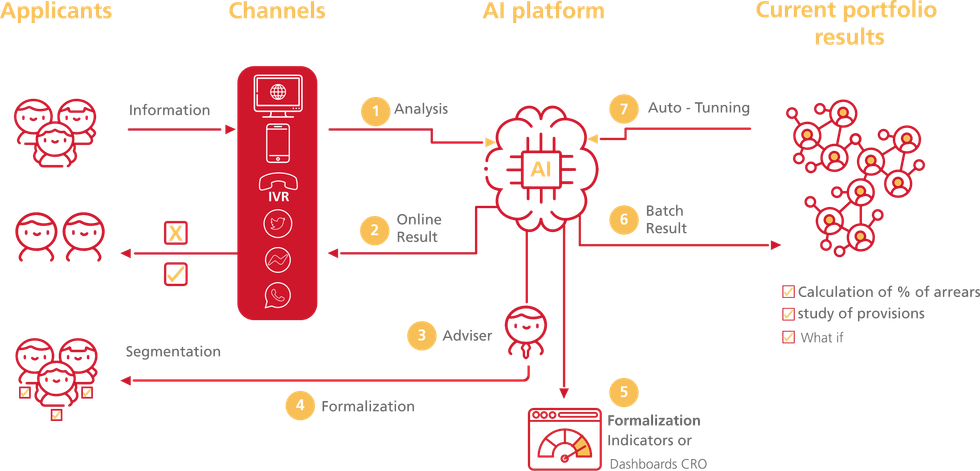

Potential partners apply for credit through different channels.

Ricoh Quick Approval collects the information and scores the partner based on their credit history with real-time data. It sends an automatic response with the approval and provides the analyst with this data for inclusion in the partner portfolio.

With this information, the commercial advisor contacts the customer for formalization.